In the bustling world of small businesses, where entrepreneurs tirelessly work to carve their niche, protect their dreams, and cultivate their ambitions, the role of insurance cannot be overstated. Imagine this: You’re a small bakery owner; you’ve finally realized your lifelong dream of opening a charming little café in your neighborhood. Everything is perfect from the welcoming aroma of freshly baked croissants to the laughter of satisfied customers. But what if a sudden mishap threatens to crumble all that you’ve built? Enter small business insurance online, the digital safety net that ensures your dreams remain intact even when faced with unexpected adversities.

Read More : Ditch The Struggle: This Unlikely Product Photography Hack Sells 30% More Items Instantly!

In today’s digital age, the world is at our fingertips, including essential services like insurance. Small business insurance online offers an unprecedented advantage, negating the cumbersome rituals of traditional insurance procedures. No longer are the entrepreneurs bogged down by endless phone calls or physical paperwork. Instead, with just a few clicks, they can secure comprehensive coverage, tailor-made to fit the unique challenges their businesses face. It’s an online revolution, a beacon of convenience and efficiency in the stormy seas of entrepreneurship.

The journey of building a small business is fraught with risks — financial uncertainties, legal liabilities, and unforeseen disasters lurking at every corner. However, with small business insurance online, these challenges can be managed with ease. Entrepreneurs can compare policies, customize coverage, and even seek professional advice without leaving the comfort of their cozy office or bustling store. It’s as if having a team of financial wizards in one’s pocket, always ready to offer protection and peace of mind.

The Benefits of Choosing Small Business Insurance Online

Imagine the empowerment small business owners feel when they’re no longer tethered by rigid schedules or the bureaucracies of traditional insurance agencies. Small business insurance online grants them the freedom to focus on what they truly love — growing their businesses and nurturing their customer base. By embracing this digital innovation, they can bid farewell to the anxiety of thinking, “What if?” Instead, they look forward, assured that they can tackle any challenges head-on with their trusty online insurance ally by their side.

—

Understanding the Importance of Small Business Insurance Online

Securing a robust and reliable insurance policy is imperative for small business owners. Let’s delve deeper into why online insurance is a game-changer.

In the fast-paced world of commerce, businesses are no longer confined by geographical boundaries or time zones. This means potential clients and opportunities are abundant, but so are risks. Enter small business insurance online, the virtual shield that ensures your enterprise remains resilient and robust. With comprehensive coverage available instantly, companies are aptly equipped to tackle not just local challenges but global ones too.

Imagine navigating a world where one can predict and plan for every possible business hiccup that could arise. A daunting task, indeed! However, with small business insurance online, there is a layer of smart, proactive planning that acts as a safety net. Businesses can focus on strategic growth, assured that their operational risks are being securely managed. This approach not only preserves the business’s foundation but also fuels its growth trajectory.

—

Key Features of Small Business Insurance Online

The digital era beckons a transformation in handling businesses and securing them. Online platforms offer a plethora of features that make them indispensable for today’s small enterprises.

Tailored Coverage Options

Unlike traditional insurance policies which often were rigid and one-size-fits-all, small business insurance online provides bespoke solutions tailored to a company’s specific needs. Need coverage for your inventory? Check. Want protection against data breaches? There’s a plan for that too. It’s like customizing a suit, ensuring every part of your business is snugly fit within the policy’s protective embrace.

Quick Adaptive Solutions

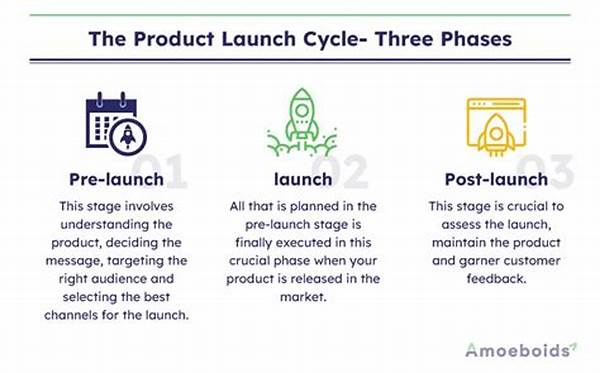

The online ecosystem is dynamic and ever-changing, much like the businesses it serves. Thus, insurance providers have stepped up, offering swift adjustments and enhancements to coverage as your business evolves. Whether you’re expanding into new territories or introducing a fresh product line, small business insurance online adapts in real-time to offer uninterrupted protection.

—

Exploring the Future of Small Business Insurance Online

The insurance industry, historically perceived as conservative and slow-moving, is witnessing a revolution powered by digital technology.

The growing demand for online services compels insurance providers to evolve or risk obsolescence. This competition birthed innovative solutions tailored to modern-day small businesses’ unique challenges. From AI-driven claim processing to blockchain-secured policy agreements, small business insurance online is at the cusp of an era where technology and risk management merge harmoniously.

Moreover, let’s touch upon the influence of data analytics. Leveraging data, insurers predict trends, calibrate premiums, and identify sector-specific risks. This predictive power ensures that business owners can pre-empt challenges and position their enterprise optimally.

In conclusion, small business insurance online presents a paradigm shift in risk management. By embracing this digital domain, entrepreneurs unlock a cornucopia of benefits — flexibility, cost-efficiency, and comprehensive coverage — all designed to help them focus on what truly matters: building their business and achieving their dreams.

—

Engaging Discussions on Small Business Insurance Online

In the vibrant world of small business forums, discussions about small business insurance online are omnipresent. These discussions dive deep into various nuances, such as securing the best policies or exploring the intricacies of claim settlements.

1. The vitality of choosing the right insurance platform.

2. Common misconceptions about online insurance services.

3. Navigating claim settlements in the digital age.

4. How to compare and select the best policies effectively.

5. Emerging trends in online insurance for startups.

6. Influences of global e-commerce on insurance needs.

7. Future predictions for online insurance platforms.

8. The role of AI in revolutionizing online insurance claims.

9. User testimonials and experiences with online insurance.

10. Common pitfalls to avoid when opting for online insurance services.

Whether you’re an industry veteran or a fresh-faced entrepreneur, these dynamic interactions provide invaluable insights, fostering a community where experiences are shared and wisdom is exchanged.