The REIT Trap: The Top 4 Mistakes Beginner Investors Make with Real Estate Investment Trusts!

Read More : Best Free Tools For Passive Income Beginners

In the thrilling world of investing, Real Estate Investment Trusts (REITs) shine brightly for their intriguing promise of high dividends and diversification. They offer a golden ticket into the expansive real estate market without the burdensome task of buying and managing property directly. This makes them an alluring choice for beginners who dream of quick cash flow and stress-free investing. Yet, like a plot twist in a thrilling novel, the path is not without its cunning pitfalls—namely, “The REIT Trap: The Top 4 Mistakes Beginner Investors Make with Real Estate Investment Trusts!”

Newbies often charge into the REIT scene, eyes filled with dreams of affluent returns but blinded to the traps lying in wait. In the investment realm, knowledge truly is power. And having that power is the first step toward achieving your financial goals. As you stand on the precipice of this enticing venture, it’s crucial to arm yourself with the insights and strategies needed to avoid these common beginner missteps. Hold onto your hats—because we’re about to dive into these pitfalls and guide you on how to skillfully navigate the REIT terrain.

Common Mistakes in the REIT World

1. Misjudging the Market’s Complexity

REITs might seem straightforward, but the complexity of the real estate market demands a solid understanding. Many beginners underestimate how external factors can influence REIT performances, such as interest rate changes or economic shifts. Awareness and continuous learning are key.

2. Ignoring Diversification

One of the most prevalent mistakes is failing to diversify. Pouring all your resources into a single type of REIT can be risky. Exploring various sectors such as retail, healthcare, or industrial can help spread risk.

3. Focusing Solely on High Yields

Chasing high dividend yields without examining the underlying company’s financial health can lead to poor investment choices. A high yield isn’t always indicative of a solid investment—look beyond the numbers.

4. Neglecting Research

Some beginners jump into REITs without thorough research, relying on myths or hearsay. Comprehensive research into management teams, market trends, and financial reports is crucial for informed decisions.

Navigating the REIT Ocean: Essential Insights

Understanding the common pitfalls is just the start. To master the art of investing in REITs, one needs to delve deeper into both their mechanisms and the real estate market they represent. REITs own and operate portfolios of real estate properties—from shopping malls to apartment complexes. This asset class demands strategic moves from investors who should view each investment as part of a larger chess game, where tactical diversification and strategic patience breed success.

Moreover, experts continually stress the importance of staying informed. Dedicate time to following market reports, studying interest rate movements, and understanding economic indicators. The wisdom is in marrying raw data with strategic action. By doing so, one can unravel the nuances of “The REIT Trap: The Top 4 Mistakes Beginner Investors Make with Real Estate Investment Trusts!” and steer their investment ship toward profitable shores.

—Beyond the Glamour: Lessons from the REIT World

Diving into the REIT realm with starry eyes can often obscure the subtle intricacies that determine profitability. Beginners are advised to regard their first REIT venture as an educational experience. Given real estate’s long-term nature, these investments typically require a blend of patience and proactive management. How one navigates this relation to market trends can spell the difference between financial gain and loss.

The Benefits of a Balanced Approach

For those ready to embark on this journey, the need for a balanced approach cannot be overstated. Embrace the idea of comprehensive strategy: invest, monitor, learn, adjust, and repeat. This mindset not only aids in sidestepping the notable pitfalls mentioned earlier but also ensures sustainable growth in one’s investment portfolio.

—Rounding It Out: Key Takeaways

In summary, avoiding “The REIT Trap: The Top 4 Mistakes Beginner Investors Make with Real Estate Investment Trusts!” means staying informed, diversifying wisely, understanding the market, and maintaining patience. As beginners arm themselves with these insights, they transform from mere investors to savvy players capable of transforming pitfalls into opportunities.

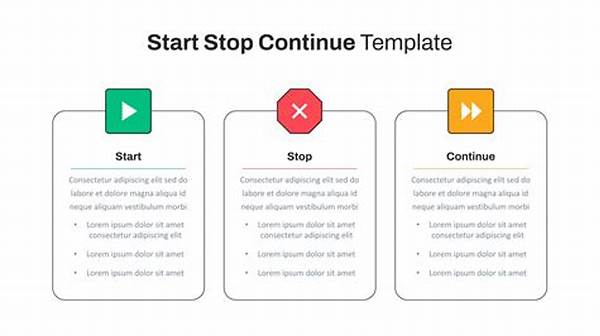

—The Essence of Graphics in Investing Narratives

1. The Lure of High Dividends

Illustrating the pitfalls of chasing high yields without thorough analysis can visually demonstrate potential consequences.

2. The Maze of Market Complexity

A visual representation of how market complexities impact REIT performances can enhance understanding.

3. Diversification Ladder

Highlighting the importance of diversifying can be depicted as a ladder, each rung representing a different REIT sector.

4. Information Highway

A graphic depicting the steady road of continual learning necessary for successful REIT investing.

5. Navigational Compass

A visual metaphor for the strategic aspect of REIT investing and avoiding common traps.

Each graphic serves to bind the textual narrative, transforming the theoretical into the tangible. Remember, the path to successful REIT investing lies not only in understanding the mechanics but also in embracing the wisdom gleaned from each investing decision. So gear up, stay informed, and let your REIT journey be a testament to informed and strategic investment.