In today’s fast-paced world, finding ways to supplement one’s income without having to constantly trade hours for dollars has become a necessity. Enter passive income—an elusive holy grail for many, and a deeply ingrained strategy for the financially savvy. Imagine a life where income flows into your bank account regularly without daily labor. A life where your money works tirelessly 24/7, without taking lunch breaks, holidays, or vacation leaves. Curious already? Let me take you on this adventurous journey where earning while you sleep isn’t just a dream but a reality that could be yours.

Read More : Stop Generic Content! The Simple Strategy That Narrows Your Niche For Higher Affiliate Conversions!

Passive income is not a new concept; however, it has gained immense popularity in recent years. The internet and advancements in technology have opened doors to a variety of passive income streams that earlier seemed inaccessible to the average person. Whether it’s through investments, digital products, or creative outlets, the opportunities are vast and varied. But with great opportunity comes great responsibility. The risk, effort, and strategy needed to establish a consistent source of passive income cannot be undermined.

Many people possess a distorted understanding of passive income—assuming it means earning without any initial effort. However, like planting a tree that eventually bears fruit, establishing solid sources of passive income requires dedication, nurturing, and sometimes a bit of trial and error. Start by asking yourself: What skills do I have? What passions drive me? Align these with the different passive income possibilities, and you could be on your way to financial freedom.

The secret sauce to securing a stable source of passive income is in diversification. Why put all your eggs in one basket, right? Multiple streams create safety nets, providing both financial security and alleviating the stress associated with reliance on a single income source. Whether you’re a serial entrepreneur or a 9-to-5 professional, a robust passive income strategy can revolutionize your approach to income generation. This blog is set to unravel some strategic insights into building your sources of passive income, stimulating both your curiosity and entrepreneurial spirit.

Understanding Different Sources of Passive Income

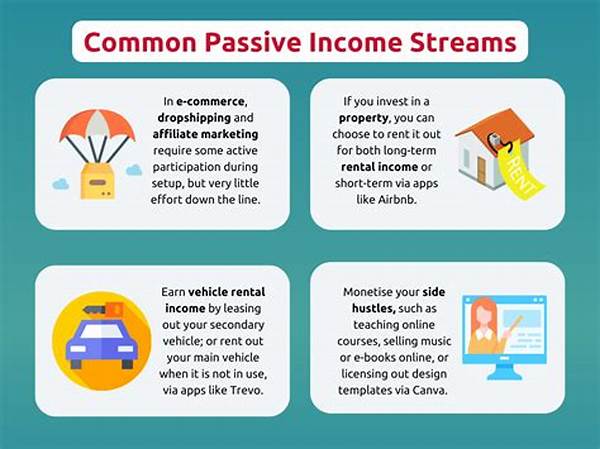

With an increasing number of individuals seeking financial independence, it’s crucial to delve deeper into understanding the many forms of passive income. Some choose real estate, investing in rental properties that promise monthly payouts with limited involvement. Others dive into the stock market with dividend-paying stocks serving as their financial cushion. Remember, every source requires different levels of investment, expertise, and risk appetite.

But what about the creative minds? There’s an escape hatch for you too! With the upsurging digital economy, creating online courses, self-publishing books, or establishing a presence on streaming platforms can yield substantial returns. Imagine writing a book and receiving royalties for life—it sounds appealing, doesn’t it? The creative spectrum of passive income is vast and colorful, granting endless possibilities for innovation.

Real-life testimonies lend credibility and stimulate aspiration. Take John, a software engineer who leveraged his coding expertise to create an online course. Within months, he was not only generating substantial income but also contributing to a community eager to learn new skills. This is the magic of passive income—once the foundation is laid, the income flow continues with minimal intervention. Crafting such income streams can be empowering and transformative, shifting one’s financial trajectory towards abundance.

—

Diverse Strategies to Generate Passive Income

Building a successful strategy around passive income is akin to brewing a perfect cup of coffee—it’s a blend of quality ingredients, timing, and a touch of creativity. The path to financial freedom through passive income is multifaceted and can be approached from different angles. Let’s explore some of these strategies that have proven effective for aspiring passive income earners.

Investment Opportunities

The investment landscape is a treasure trove for those seeking sources of passive income. From traditional avenues like rental properties to the modern marvel that is peer-to-peer lending, each opportunity comes with its flavor of reward and risk. By investing in rental properties, you create a steady stream of income through tenants’ rents, requiring minimal ongoing effort once set up.

Another attractive option is dividend stocks, where you earn a share of the company’s profits regularly. This route requires sound knowledge and timing but can yield handsome returns in the long run.

Creative Endeavors and Digital Platforms

For the creatively inclined, the internet serves as an expansive platform for monetization. Writing eBooks, creating online courses, or venturing into affiliate marketing are some promising methods to establish a source of passive income. In a world where expertise sells, sharing knowledge through courses not only impacts others but also carves out a stream of royalty income anchored in the digital space.

With platforms like YouTube and podcasting gaining traction, content creators are finding new ways to monetize their creative outputs. The essence of a creative strategy lies in consistency and value addition—creating content that resonates with audiences ensures sustainable passive income channels.

—

Exploring Additional Sources of Passive Income

Creating multiple sources of passive income is akin to designing a diversified investment portfolio—it’s all about balance and foresight. Here are a few more options to enrich your passive income pursuits:

Advantages of a Diverse Passive Income Portfolio

Beyond the financial benefits, developing sources of passive income offers flexibility and peace of mind. It shifts your life from a cycle of dependence on active income to a more balanced financial ecosystem. When one source faces challenges, others can fill the gap, providing stability and reassurance. The freedom that comes with having a diverse portfolio is not just financial—it’s emotional freedom, reducing stress and advocating for a lifestyle centered on choice rather than necessity.

The journey into passive income is not merely about financial gain. It’s a transformative process that invites exploration, innovation, and self-discovery. Develop the courage to step out of your comfort zone, and you may just uncover an unstoppable financial engine in the form of passive income. Keep learning, stay adaptive, and in due time, let your money work for you, paving the path towards financial liberation.

Interactive Illustrations of Passive Income Sources

—

Key Insights into the World of Passive Income

Diving into the world of passive income is an enlightening journey that offers profound insights and endless opportunities. Understanding that these income streams don’t simply emerge overnight is crucial—it requires a strategic blend of vision, patience, and adaptability. Each passive income source, whether it be royalties, rental income, or dividends, comes with its mechanics and timeline. Recognizing the timelines for returns and understanding the intricacies of each stream will ensure a broader perspective, mitigating risks effectively.

Although investments like real estate or stock dividends may require substantial initial capital, digital pursuits often require more time and creativity. Digital landscapes, such as blogging, YouTube, or online courses, serve as platforms where creativity meets income, if leveraged correctly. These avenues offer the flexibility of starting with lower barriers to entry while potentially yielding significant returns over time.

The significance of continual learning and adaptation cannot be overstated in the dynamic realm of passive income. Staying informed about market trends, technological advancements, and shifting consumer preferences equips you with the resilience to evolve and capitalize on emerging opportunities. Building meaningful relationships and collaborating with others can also amplify success, offering unique insights and opening doors to unexplored ventures.

By creating diversified income streams, you not only secure your financial future but also craft a sustainable lifestyle. Imagine having the financial freedom to pursue passion projects, travel the world, or invest in future business endeavors. The true beauty of passive income lies not just in the income itself, but in the doors it can open, leading to both personal and professional growth.

Harnessing passive income is an art—an art worth mastering for anyone eager to sidestep the monotonous grind, creating a financial safety net that allows for more freedom, choice, and the pursuit of true happiness. Remember, every moment spent building and refining your sources of passive income is an investment toward a future of unlimited potential and security.