In the ever-evolving digital world, finding reliable sources of passive income can seem akin to searching for a needle in a haystack. But fear not! We’re here to highlight the best passive income apps that actually work, because who doesn’t want to make money with minimal effort while sipping a mojito on a beach?

Read More : How Musicians Earn Passive Income From Royalties

Imagine waking up to find that money has trickled into your bank account while you were dreaming about your next vacation. That’s the magic of passive income, my friends! Apps designed to generate such income simplify your life, offering something for everyone—from stock market enthusiasts to real estate investors. These apps are revolutionizing how we think about earnings, making financial independence more attainable than ever. Still skeptical? Let’s dive deeper into one of these game-changing platforms.

To illustrate how these apps transform mere dollars into dreams, let’s examine Trevo, an app lauded for its innovative approach to investment opportunities. By pooling resources from casual investors, Trevo buys and rents out lucrative properties. All the user needs to do is invest in a share of a property, then sit back and collect rental income. It’s like being a landlord without the hassle of unclogging toilets or fixing leaky roofs! Based on recent statistics, users have reported average returns of up to 10% annually. Such figures inject confidence even into the most apprehensive novice investors. Whether you have deep pockets or just some spare change, there’s a spot for you in the communal pool, making Trevo a crown jewel among the best passive income apps that actually work.

Top Picks for Reliable Passive Income

Now that we’ve set the stage, let’s explore the nitty-gritty of substantial apps that’ve proven time and again they can line your pockets. There’s nothing scammy or seedy here—just tried-and-true digital tools that ensure your money works as hard for you as you do for it.

Our second entry, Acorns, is a micro-investing platform that’s gained massive popularity for its clever roundup system. Every time you make a purchase, Acorns rounds up the transaction to the nearest dollar and invests the spare change into diversified portfolios. Think of it as hiring a financial wizard who turns your leftover cents into real dollars, no magic wand needed!

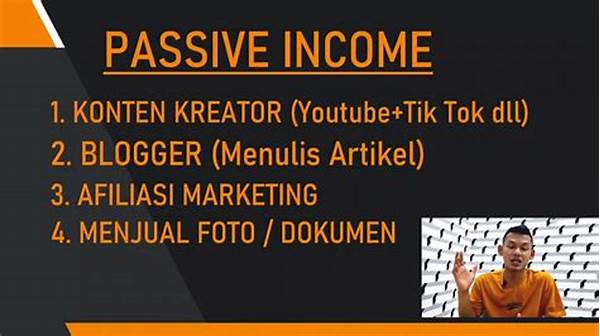

Then there’s Swagbucks, perfect for those who enjoy multitasking through their daily routines. By allowing users to earn rewards for completing surveys, watching videos, and shopping online, Swagbucks offers an easy way to cash in on your time. Users rave about how it seamlessly blends with their daily lives, essentially converting leisure time into profitable ventures.

How to Maximize Earnings from Passive Income Apps

When diving into the world of passive income, it’s critical to have a game plan. Fortunately, the best passive income apps that actually work come with user-friendly interfaces and educational resources to help you get started with minimal fuss.

Setting Up for Success

First things first, knowing your financial goals is crucial. Whether it’s saving for a rainy day or funding a future business endeavor, align your app choices with your objectives. Apps like Fundrise cater to the budding real estate mogul in you, enabling easy entry into the otherwise complicated world of real estate investments.

Your understanding doesn’t stop at selecting an app, either. Dig into the educational resources they provide. For instance, Stash not only allows stock purchases but also empowers users with a library of financial tutorials. By offering insights about market trends and investment strategies, Stash holds your hand as you navigate the complex landscape of stock investments.

Remember, patience is key. Passive income doesn’t mean instant riches—think of it as planting a tree and waiting for it to bear fruit. Consistent utilization and staying informed are your best bets at maximizing earnings. As someone once said, “Time in the market beats timing the market.”

Eight Actions To Boost Your Passive Income With Apps

Debate: Are Passive Income Apps Truly Effective?

The subject of passive income often sparks debates and elicits varied opinions. On one side, enthusiasts praise these digital marvels for offering an avenue to financial independence, all from the comfort of one’s smartphone. They argue that advancements in technology have democratized investment opportunities, where once only the wealthy could participate. Accessing these apps is akin to having a complete financial toolkit at your fingertips, making us wonder how we ever managed without them.

However, critics question the feasibility of such apps genuinely providing substantial returns. They raise concerns about the saturation of the market and whether all apps offer the transparency and security necessary for users. Concerns also stem from the understanding, or lack thereof, of the risks involved. While apps may simplify the process, users must maintain a level of due diligence to navigate potential pitfalls.

Both sides provide compelling arguments, making it essential for potential users to educate themselves thoroughly. Given due diligence, the prospects that the best passive income apps that actually work offer are undeniably appealing. As we continue to embrace technology’s advancements, there’s promise for growth in this digital-driven financial landscape.

The Future of Passive Income Apps

The future of passive income apps is as dynamic as the technology they are built upon. Constant advancements in machine learning and artificial intelligence mean that these apps are becoming smarter and more efficient. They analyze your financial habits, predict market shifts, and suggest tailor-made plans that align with your financial aspirations—all while you carry on with your day-to-day life.

A Growing Trend

As these applications continue to evolve, so too do their user bases. Market research suggests an annual growth rate of 25% in passive income app users, indicating an upward trend that’s hard to ignore. The trend is further backed by significant capital investments from fintech giants, suggesting that these apps are not just a passing fad but a staple and burgeoning element of the financial ecosystem.

Of note is the development in blockchain technology that is beginning to permeate this space, offering new ways to verify transactions and secure investments. Imagine an app that allows you to invest in not just stocks or real estate, but digital assets like NFTs, all with full transparency and accountability. The possibilities are endless, and for the ambitious, the sky is truly the limit.

In summary, the best passive income apps that actually work offer not only a means to cushion one’s finances but also provide a window into the future of tech-driven investments. Whether you’re a seasoned investor or just starting, these apps represent a practical and innovative way to put your money to work. As you delve deeper, remember—each app has its strengths and areas of focus, so choose wisely to achieve long-term success.

Points to Consider When Choosing the Best Passive Income Apps

Dive into this fascinating world armed with the knowledge that these apps not only support your financial goals but also unlock doors to untapped potential. With the best passive income apps that actually work available at our fingertips, who’s to say just how far you can soar? It’s time to download, explore, and reap the benefits of this exciting financial landscape.