In the dynamic world of business, staying ahead of the competition is not just about having the best products or services. It’s also about ensuring seamless operations, efficient transactions, and maintaining strong relationships with stakeholders. Enter business online banking—a revolutionary concept that has redefined how business transactions are conducted globally. This digital age marvel allows businesses to manage their finances with unprecedented ease and accuracy, bringing in a wave of innovation that’s both exciting and transformative. In a landscape where time is money, business online banking becomes an indispensable tool, streamlining operations and cutting down administrative hassles.

Read More : 5 Toxic Habits You Need To Quit Now To Run A Sustainable And Profitable Online Business!

Imagine a bustling office where financial transactions are just a few clicks away. Employees manage payroll, suppliers are paid timely, and overseas transactions are simplified—all from the comfort of the office. No longer is business banking constrained by the physical boundaries of brick-and-mortar branches. This is the reality that business online banking presents—a world where flexibility and efficiency meet head-on. Whether you’re a small business owner or a corporate giant, the advantages of online banking in the business realm cannot be overstated. But how exactly does it bolster business growth, and what sets it apart from traditional banking methods?

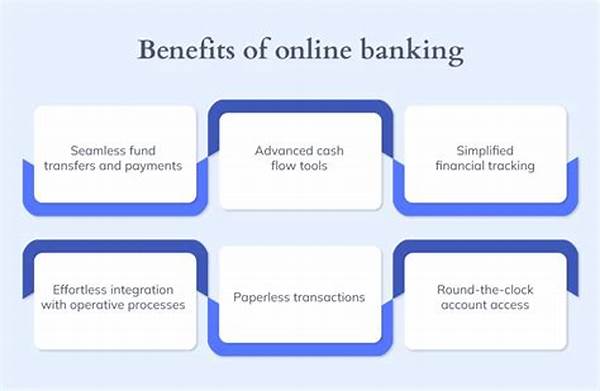

From managing multiple accounts to real-time monitoring of cash flows, business online banking offers features designed to cater specifically to the needs of businesses. With sophisticated security measures, businesses can rest assured that their transactions are as secure as they are swift. Moreover, these platforms provide comprehensive insights into financial health through detailed reports and analytics. It’s like having a financial analyst constantly working behind the scenes. Such insights allow businesses to make informed decisions that can positively impact their bottom line.

Not only does business online banking provide operational benefits, but it also plays a crucial role in strategic planning. By analyzing transaction patterns and cash flow trends, companies can forecast financial needs and allocate resources more effectively. This proactive approach can prevent financial bottlenecks and optimize capital usage, ultimately leading to sustainable growth. As businesses scale new heights, the role of online banking becomes increasingly significant in ensuring they have the financial infrastructure to support expansion.

The Future of Business Online Banking

As technology continues to advance, the capabilities of business online banking are set to expand even further. The integration of artificial intelligence and machine learning could offer businesses predictive insights and greater automation in financial tasks. The vision for the future includes a world where financial operations are almost entirely seamless, enabling businesses to focus on their core competencies without being bogged down by administrative burdens.

—

Understanding Business Online Banking: Features and Benefits

In an era where technological advancement dictates the pace of business, understanding the intricacies of business online banking becomes essential. From automating mundane financial tasks to offering real-time analytics, the platform provides a suite of features tailored for business excellence. Here, we delve deeper into what makes business online banking a game-changer.

At its core, business online banking offers unparalleled convenience. Picture this: no more standing in long queues at the bank or rushing to beat branch closing times. Online platforms ensure round-the-clock access to your accounts, allowing you to conduct financial transactions at any given time. This 24/7 availability ensures businesses can operate without disruption, avoiding potential delays in transactions that could impact operations.

Security, a priority for any business, is front and center in the realm of online banking. Sophisticated encryption and authentication protocols are employed to ensure your transactions remain confidential and protected against cyber threats. These security measures inspire confidence, encouraging more businesses to embrace this digital shift. The question remains—how else does business online banking fuel business success, and what untapped potential lies within?

Trends in Business Online Banking

Recent trends suggest a move towards more integrated and user-friendly interfaces. Banks are investing heavily in creating platforms that are not only secure but also intuitive. These changes reflect a deep understanding of user needs and expectations. Mobile banking apps, for instance, have revolutionized the way businesses think about banking, offering a full suite of services right from the palm of your hand.

Embracing Innovation in Business Online Banking

This transformative approach to business banking does more than offer convenience; it catalyzes innovation within businesses. With advanced features like automated payment systems and comprehensive financial dashboards, businesses are better equipped to innovate and react swiftly to market changes. The role of business online banking in fostering innovation is increasingly being recognized as instrumental in maintaining a competitive edge.

In conclusion, business online banking is not just a trend—it’s a fundamental shift towards a more efficient, secure, and innovative financial landscape for businesses. As technology continues to evolve, forward-thinking businesses will harness the potential of online banking to drive growth and efficiency.

—

Key Points about Business Online Banking

—

Discussion on Business Online Banking

The discourse on business online banking invariably leads us to the crossroads of technological advancement and business growth. But what are the broader implications of this digital shift on the business ecosystem? On a fundamental level, business online banking democratizes access to financial services. By eliminating geographical barriers, even small businesses can compete with larger enterprises on a global scale, leveling the playing field and fostering entrepreneurship.

For many businesses, the transformation isn’t solely about ease of operation but also the deeper integration of financial data into strategic planning. With advanced data analytics, companies can unlock insights that were previously inaccessible, driving informed decisions. It’s like having a crystal ball that provides glimpses into potential future trends and shifts. This predictive prowess is invaluable in a world where agility defines success.

On an individual level, employees benefit from streamlined processes and automated workflows, allowing them to focus on more strategic initiatives. The reduction in manual errors and time saved from administrative tasks can significantly enhance productivity and job satisfaction. With less time spent on mundane tasks, employees can channel their creativity into projects that drive business value.

In closing, business online banking not only transforms how businesses manage finances but also shapes their strategic capabilities. As businesses navigate an increasingly complex financial landscape, the ability to adapt and leverage digital tools will define their growth trajectory. Embracing this shift is not merely optional—it’s an imperative for those seeking lasting success in the competitive business world.