- The Ultimate Investment Secret: How to Use Dividend Stocks to Pay Your Monthly Bills!

- Why Dividend Stocks Are the Financial Savior You Need

- Introduction

- The Secret Behind the Ultimate Investment Strategy

- Building a Financial Safety Net with Dividend Stocks

- Embracing the Lifestyle Change

- Action Steps to Unlock the Ultimate Investment Secret

- Crafting Your Roadmap to Financial Freedom

The Ultimate Investment Secret: How to Use Dividend Stocks to Pay Your Monthly Bills!

Imagine this: a steady stream of passive income that effortlessly pays your monthly bills, while you sip your morning coffee without a single financial worry. Sounds like a dream, right? Well, let me let you in on “the ultimate investment secret: how to use dividend stocks to pay your monthly bills!” Yes, that’s right. Dividend stocks are not just another investment vehicle; they are your lifeline to financial freedom!

Read More : Beyond Blogging: 6 Under-the-radar Passive Income Streams That Require Less Than 5 Hours Weekly!

Investing in dividend stocks is like planting a money tree. Every month or quarter, depending on the stock, you receive a dividend payment simply for being a shareholder. These payouts can be so consistent and generous that, over time, they can cover your living expenses, rendering your paycheck purely optional. Consider dividend stocks as your financial foundation, helping you to strategically build wealth over time while enjoying a steady income. By choosing the right assets, your dividends can all but guarantee that your bills are a worry of the past.

So, how do you begin leveraging dividend stocks effectively? First, educate yourself on the types of companies offering these lucrative payouts. Look for those with a track record of consistent earnings and growing dividends. It’s important to diversify your investments across various industries to bolster your portfolio against market fluctuations. Visit financial blogs, read investment analyses, and even seek advice from seasoned investors. And remember, the ultimate investment secret: how to use dividend stocks to pay your monthly bills! is not just about accruing wealth; it’s about freedom—the freedom to live life on your own terms.

Why Dividend Stocks Are the Financial Savior You Need

Understanding the magic behind dividend stocks is straightforward. Here’s what makes them an investor’s best friend: they offer potential for both income and growth. It’s like having your cake and eating it too. You receive regular income through dividends, while your underlying investment appreciates over time. This makes dividend stocks a preferred choice for those looking to build a secure financial future without the erratic emotional ride of more volatile investments.

—

Introduction

Every investor’s dream is to create a portfolio that sustains a comfortable lifestyle, regardless of market ups and downs. But for many, this dream might seem distant or even impossible. Enter “the ultimate investment secret: how to use dividend stocks to pay your monthly bills!”—a time-tested strategy known by savvy investors yet largely ignored by the average person. It’s not just a method; it’s a revelation that can transform your financial existence.

The Secret Behind the Ultimate Investment Strategy

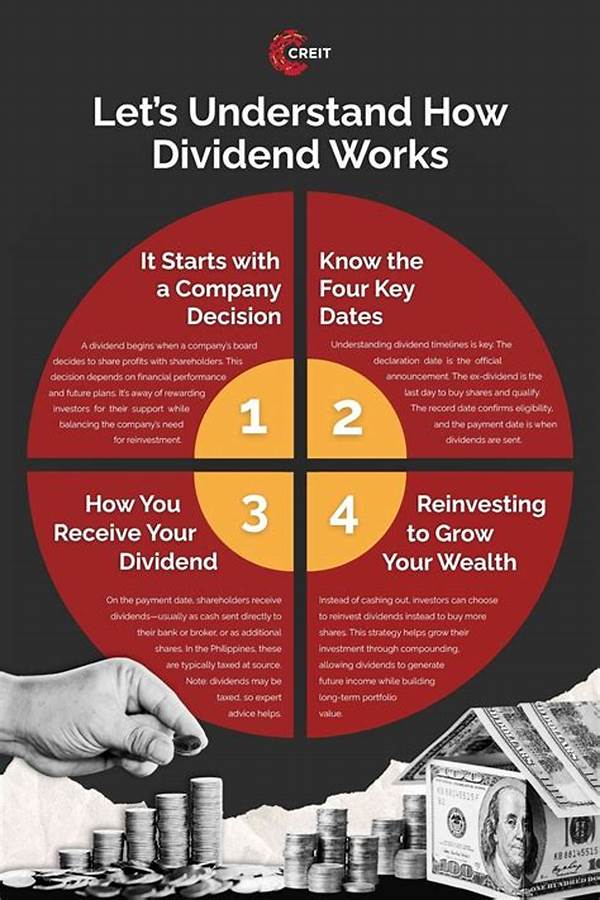

Dividend stocks are not a novelty in the investment world. However, their potential to pay your monthly bills can be a revelation. By focusing on dividend-paying companies, you create a passive income stream. But how does this differ from other passive income strategies, you might ask? Simple: dividends offer recurring payments without selling the underlying asset. You’re essentially earning while maintaining ownership.

Building a Financial Safety Net with Dividend Stocks

A common misconception is that these stocks are only for retirement. While they do offer financial security later in life, they can also support your everyday living expenses. Imagine paying your rent, utilities, or groceries entirely from the dividends you earn. This approach doesn’t just secure your future financial freedom—it funds your present.

Embracing the Lifestyle Change

Switching to a dividend-focused life allows you to embrace a minimalistic approach to finance, focusing on building wealth passively. It’s a lifestyle change that brings peace of mind, enabling you to focus on what truly matters—be it travel, family, or personal development. The ultimate investment secret is not just about accumulating wealth; it’s about enriching your life.

—

Action Steps to Unlock the Ultimate Investment Secret

Crafting Your Roadmap to Financial Freedom

Building a strategy around “the ultimate investment secret: how to use dividend stocks to pay your monthly bills!” involves not just choosing the right stocks but also having a clear plan. Starting small with a focus on quality enterprises can grow into significant financial security over time. Pair your investments with proactive financial planning to ensure you are maximizing utility and growth potential. Consider setting both long-term and short-term financial milestones to track your investment’s journey.

The allure of financial independence through dividends isn’t just about buzz—it’s about laying down a secure, reliable path to financial stability. As each dividend payment arrives, it affirms your decision to invest wisely. It’s more than just payment for holding a stock; it’s evidence of a sound investment strategy executed to perfection. Transitioning from relying on an active income to a mix that includes passive dividend payments provides a sense of liberation and flexibility to dictate your life’s path.

By embracing “the ultimate investment secret: how to use dividend stocks to pay your monthly bills!”, you’re not just investing in stocks—you’re investing in your future self’s freedom and peace. This strategy makes financial independence not just a goal but a lifestyle choice, leading you toward a life less burdened by the concern of financial constraints. As you move through each financial chapter, dividend stocks will silently work in the background, steadily supporting and fulfilling your monetary needs.