I’m happy to help you with your content needs on “income passive”. Below, I’ll draft various sections as requested, beginning with the article.

Read More : The 7-day Income Reset: A Simple Plan To Identify Your First Profitable Passive Income Stream!

Have you ever dreamed of earning money while you sleep? The enticing concept of generating income without continuous effort or time investment has magnetized many to the possibility of income passive. Picture this: you’re on a beach, enjoying a serene sunrise, sipping your favorite coffee— and at the same time, your bank account is growing. Sounds like a dream come true, right? But wait, there’s more. This isn’t just a fantasy perpetuated by entrepreneurial myths; it’s a logical and attainable financial goal.

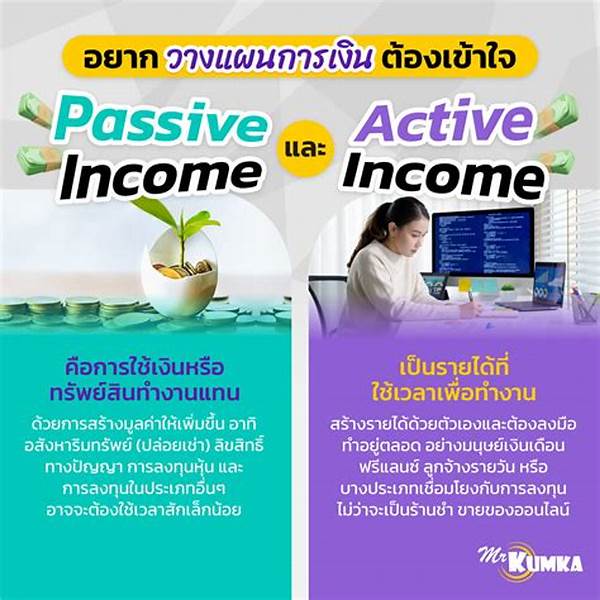

Let’s dive deeper into what income passive actually is. At its core, income passive is money you earn with little to no ongoing effort. We’re not talking about clocking in and out of a day job, but rather creating streams of revenue that can thrive with minimal supervision. Whether it’s through investments in stocks, real estate, or creating digital products, the concept of income passive opens up a realm of possibilities that promise financial freedom and security.

It’s essential to break free from the notion that making a living has to be throat-cutting or relentless. The traditional 9-5 job model, although stable for some, doesn’t suit everyone. In an era where side hustles and gig economies flourish, the idea of having consistent income passive becomes even more appealing and deeply intertwined with modern financial strategies.

The journey to establishing income passive isn’t just about finding the right investment; it’s also about mindset transformation. Imagine joining a community of like-minded individuals who share and learn from each other’s experiences in generating income passive. This isn’t just isolated information. It’s a lifestyle shift that’s waiting to be embraced. Support and creativity are key; think of income passive as your personal playground of experiments and innovation.

Focus on developing diverse income streams so you won’t be dependent on a single source. This doesn’t just protect you from market volatility but allows you to grow your skillset across various fields, hence increasing your potential revenue streams. Now’s the time for action. Start small, be consistent, and watch your income passive grow exponentially over time. The opportunities are endless, and the road to financial independence is within reach.

Exploring the Potential of Income Passive

As we delve into the specifics of income passive, let’s explore actionable steps and insights that can serve as your guide in this financial journey.

—

Income passive, while intriguing, raises a lot of questions and curiosity. How does one transition from active earning to generating income passive effectively? With finance being a life-altering element, venturing into income passive begins with a shift in perspective and understanding of financial instruments.

First off, get comfortable with the idea of delayed gratification. In the pursuit of income passive, patience isn’t just a virtue—it’s a strategy. Unlike typical jobs where effort and reward are almost immediate, income passive requires an initial investment of time, resources, or money, with the understanding that the returns may come gradually. Your focus should be on the long-term benefits that outweigh short-lived efforts.

Consider this example: investing in rental properties. Upfront, it may require substantial capital and careful planning. Yet, with time, the property generates rental income with little input from you, epitomizing the concept of income passive. Similarly, an increasingly popular income passive path is through digital creations—books, courses, or apps—that once developed, can continually provide revenue.

Navigating the Passive Income Landscape

Furthermore, income passive aligns perfectly with the current digital age, where online platforms offer vast opportunities for earning. From affiliate marketing to creating YouTube content, the digital touchpoints are as diverse as they are promising. With the internet being an indispensable tool, strategizing on how to leverage it for income passive should be a priority.

Common Misconceptions and Realities

However, it’s crucial to dispel the misconceptions associated with income passive. Some believe it is “easy money,” but like any worthwhile venture, it demands initial effort, learning, and often upfront capital. The misconception that income passive is an overnight success should be replaced with the insight that it is an exercise of consistency and strategy over time.

Understanding market trends and consumer behavior, particularly in the areas you invest in, is pivotal. Empirical studies and expert analyses about market movements can better inform your decisions and prevent ill-advised investments within your income passive ventures. Networking and seeking mentorships also significantly enrich one’s journey towards accruing income passive.

Lastly, embracing failures and learning from them builds resilience. Every setback is a learning opportunity, refining your strategies and honing your ability to generate income passive more effectively. By engaging with communities, participating in forums, and listening to podcasts, you gain diverse perspectives that enhance your understanding and approach.

—

Structuring Your Passive Income Journey

Embarking on a quest towards income passive requires a carefully laid-out plan. Drawing inspirations from successful entrepreneurs, the blueprint often involves a foundational framework adaptable to various income streams. Starting with goal setting—clearly defining what financial independence means to you— and mapping out precise timelines becomes pivotal in keeping track of your progress.

Analyzing current financial standings provides a clear picture of what resources can be allocated towards building income passive. Understanding cashflow, assets, and liabilities is fundamental in determining the amount of risk you can bear and thus choosing suitable passive income avenues. Risk assessment also entails market research, paying attention to economic indicators, and aligning your income passive strategies with the current trends.

The flexibility of income passive strategies means adapting to changes and embracing innovative approaches. Continuous education, adapting to new technologies, and yet maintaining a diversified portfolio ensure stability and increase chances of yielding high returns. Implementation of accountability structures—like maintaining spreadsheets or using financial tools—augment clarity on income performance and quick decision-making.

Maximizing Income Passive Opportunities

Managing a balanced workflow between active working hours and nurturing income passive strategies requires a calculated approach. For most, transitioning involves a period where active incomes support the building and scaling of passive ventures. Utilizing weekends, breaks, or idle hours to incrementally grow and manage income passive paths further enhances effectiveness and feasibility.

The importance of having a dynamic mindset cannot be understated. Strategies may need tweaking and revamping according to evolving markets or personal circumstances. Integrating flexibility and resilience in your passive income approach fosters sustainability and maximizes results, positioning you advantageously towards achieving financial autonomy.

The journey to income passive isn’t a solitary one. Engage in networks, communities, and online platforms for insights, guidance, and partnerships. By fostering an inquisitive and proactive financial culture, the passive income landscape becomes not just a means to an end, but a vast horizon of economic empowerment and personal growth.

—

This content aims to provide a condensed yet comprehensive overview of income passive, with each section designed to educate, inspire, and provide actionable strategies for achieving financial growth.